Fixed deposits (FDs) are becoming increasingly appealing due to their enticing interest rates. Meanwhile, debt funds have lost the indexation benefit, thus raising the question: Are FDs and debt funds, particularly short-duration debt funds, now on a level playing field? Which of them might be a wiser investment choice? Let's evaluate our options.

Has indexation removal benefitted FDs?

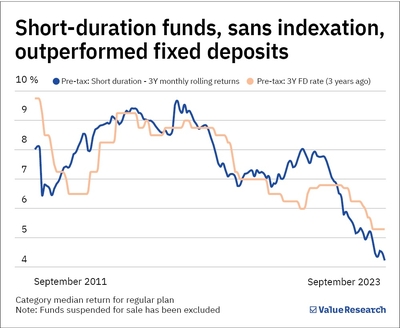

The removal of indexation benefit from debt funds is disheartening, especially as the post-tax return gap between short-duration funds and FDs has notably narrowed. However, these funds (even their regular plans) outperformed FDs.

In our analysis, where if there was no indexation and the tax treatment for FDs and short-duration funds were the same, we found that the regular plans and direct plans (of short-duration funds) still outshone FDs 61 and 76 per cent of the instances, respectively, over the last 12 years.

Our methodology involved studying the three-year median returns every month for short-duration debt funds and comparing them with the returns of three-year FDs (of SBI).

Yield-to-maturity (YTM) comparison

Yield-to-maturity (YTM) indicates the return expected from a debt fund if it is held till maturity.

The category average YTM for short-duration funds stands at 7.69 per cent as of October 2023, exceeding the approximately 7-7.25 per cent returns offered by three-year FDs. Factoring in expenses (expense ratio) slightly lowers the category average returns of short-duration funds to 7.35 per cent.

With fund houses anticipating future rate cuts (as interest rates are believed to have peaked globally and in India), short-duration funds are poised to deliver better returns. As interest rates fall, bond prices rise, rendering short-duration debt funds attractive.

Additional considerations

- While FDs assure returns, they are less liquid and charge early withdrawal penalties. In contrast, short-duration funds offer greater liquidity without penalising early withdrawals.

- Despite the absence of indexation benefits, the gains from debt funds are taxed only when you sell the fund. Interest from FDs is taxed every year.

- FDs offer interest rate predictability. But short-duration funds excel in a fluctuating interest rate environment. Fund managers can dynamically adjust portfolios and increase exposure to longer-duration bonds in anticipation of future rate cuts. This enhances their potential for optimised returns.

Our word

In the post-indexation era, debt funds are still a viable option for the core fixed-income portfolio. Higher returns can be expected if interest rates fall.

For those seeking certainty, fixed deposits might be apt. On the other hand, individuals comfortable with some volatility can consider short-duration debt funds.

To check the best buys in the short-duration debt category, click here.

Also read: Yehi hai wrong choice