Home loan borrowers often grapple with a common dilemma - whether to utilise their accumulated savings to reduce the burden of their home loan or invest it in equities. This becomes particularly pressing in an environment marked by escalating interest rates.

Impact of repo rate on home loan interest rates

The home loan interest rates have risen significantly over the years. In the case of HDFC Bank, it has risen from 7.95 per cent to about 9.40 per cent in the last three years.

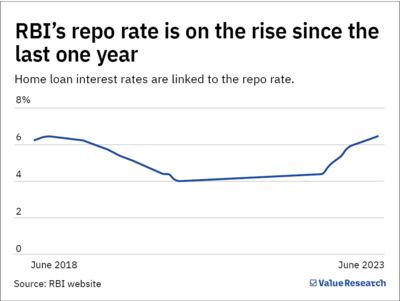

It is important to note that interest rates on home loans are influenced by repo rates. [Repo rate is the interest rate at which the Reserve Bank of India (RBI) lends money to banks]. Banks in turn add a mark-up over the repo rate to calculate the interest rates on home loans.

For instance, HDFC Bank currently adds a mark-up of about 2.25 to 2.90 per cent to the prevailing repo rate of 6.5 per cent, resulting in an annual interest rate of 8.75 to 9.40 per cent.

The repo rates have been on a rise since the past one year. As a result, the home loan interest rates have also increased significantly. In light of this, a pertinent question raised by our readers is whether our general advice to refrain from prepaying the home loan and instead invest in equities still holds true.

We decided to do some number-crunching to solve this dilemma.

Case of Dharmendra

Let's assume Dharmendra (hypothetical name) took a home loan 20 years back for Rs 45 lakh at 10 per cent interest and a tenure of 20 years. But, the actual interest rate is less than 10 per cent? Right, we have intentionally assumed a higher rate just to check whether our advice still holds true even under the assumption of a high interest rate.

Dharmendra's EMI (equated monthly instalment) would have stood at Rs 43,426 throughout the tenure. He also had savings of Rs 10 lakh accumulated by the side 10 years after he took the loan.

Let's evaluate two scenarios for Dharmendra and see which one would have served him better.

Scenario 1: Dharmendra prepaid Rs 10 lakh of the home loan

The loan tenure would have come down to 16 years, after which he would be a proud homeowner with zero liability.

Dharmendra had already been repaying his loan for 10 years. He was eligible for a tax deduction of Rs 2 lakh annually on home loan interest payments. Assuming he belonged to the 30 per cent tax bracket under the old tax regime, he would have been able to save around Rs 60,000 yearly in the initial phase of the loan.

Now, let's assume Dharmendra started an SIP in an index fund tracking the Sensex with the amount he had saved on taxes over the years and diverted the EMI of Rs 43,426 (monthly) in the subsequent 17th, 18th, 19th and 20th years to the same fund.

In this case, today, after the completion of the original loan tenure of 20 years, he would be a homeowner, having no liability and a mutual fund corpus worth over Rs 81 lakh.

Scenario 2: Dharmendra invested Rs 10 lakh in equities

Let's assume Dharmendra used the same index fund for starting an SIP of the amount saved on tax because of the home loan interest. He further invested the extra savings of Rs 10 lakh over three years in the same fund. Today, by the end of the loan tenure, he would have a home, no liability and a mutual fund accumulation worth over Rs 84 lakh.

Our word - still holds true

Despite the higher interest rate, it is advantageous to adhere to the old thesis of not prepaying the home loan. Therefore, if you go with option 2, you are likely to have a larger corpus.

We, at Value Research, generally advise against borrowings unless it's an emergency. However, exceptions can be made for certain situations, such as taking a home loan, as they are generally cheap, aid in asset building, and offer tax savings.

That said, if you feel the home loan is a burden, we suggest you prepay it. No investment is worth losing your sleep.

Also read: A five-point guide to buying a home