Before PAN (Permanent Account Number) cards existed, paper ledgers and physical documentation ruled the financial world. Tracking down misplaced or forgotten investments was akin to searching for a needle in a haystack.

But fast-forward to the present day, reclaiming these investments has become more streamlined, thanks to modern systems like the IEPF and the recently-launched UDGAM. So, let's look at both the platforms in greater detail and how they can help you retrieve your lost money.

Investor Education and Protection Fund (IEPF)

Although IEPF's primary objective is to promote investor education, awareness and protection, the fund is also associated with several stock market-related investments, including:

- Shares of public companies

- Unclaimed dividends

- Matured debentures

- Application money due for refund

- Deposits matured under a company's deposit scheme (except banks)

After seven years of remaining unclaimed, the abandoned money gets transferred to IEPF. Companies move these funds to give the owners a chance to recover them. So, if you want to claim your lost money via the IEPF platform, here's a step-by-step guide.

Steps to claim company stocks through IEPF

1. To check if there are any unclaimed shares or dividends belonging to a family member, visit here.

2. Input your family member's name in the search field. While the folio and DP account numbers are not mandatory, they can help refine your search.

3. Congratulations if their name appears in the search. You can click on it for more details, such as the number of shares and the total amount due (see screenshot).

If you're looking for assets belonging to a deceased relative, these are the additional steps you need to take:

- If the value of the investment exceeds Rs 5 lakh, you will need to secure a court order. Without a Will, you must receive a succession certificate in your favour from the court.

- Then, notify the respective company or their Registrar and Transfer Agent (RTA) about the transmission process.

- Once the company verifies the request, it will issue you an entitlement letter, enabling you to reclaim the shares from IEPF.

After you get the entitlement letter, continue with the following process:

4. Log in here to create an account.

5. Next, fill out the IEPF-5 application form available under the 'MCA Services' section. Make sure to print out the acknowledgement for your records.

6. After that, send the following physical documents to the nodal officer of the company whose shares you are claiming, including:

- IEPF-5 form

- Acknowledgement with the SRN (Service Request Number)

- The original indemnity bond and original advance receipt

- Original share certificate or a copy of the transaction statement in case of securities held in demat form

- Self-attested copy of your Aadhaar

- Proof of Entitlement (usually the entitlement letter from the company)

- Cancelled cheque

- Copy of passport, OCI and PIO card, in case you're a foreigner or NRI

7. The company will then verify your claim and share the details with IEPF. Upon approval, the shares will be transferred to your demat account, and the dividends will be sent to your bank account.

Points to remember

The procedure can span several months. That said, patience will bear fruit in the end. While IEPF helps you retrieve unclaimed assets like shares, dividends and matured debentures, it doesn't encompass all financial assets. Bank deposits, for example, fall outside its purview. That's where UDGAM steps in.

Unclaimed Deposits Gateway to Access Information (UDGAM)

As per RBI, a staggering Rs 42,272 crore (as of March 2023) is lying idle in unclaimed bank deposits! Unclaimed bank deposits are all savings and current accounts that have been lying dormant for 10 years. Also, term deposits that remain unpaid 10 years after their maturity date are included in unclaimed deposits.

Although banks usually publish a list of unclaimed accounts on its website, UDGAM offers a centralised hub for this data. Here's how you can check for them.

Steps to claim investments from UDGAM

1. Visit the UDGAM portal and register yourself.

2. Once you log in, type the name of the account holder whose unclaimed deposits you are trying to locate. Ensure the name matches the bank record.

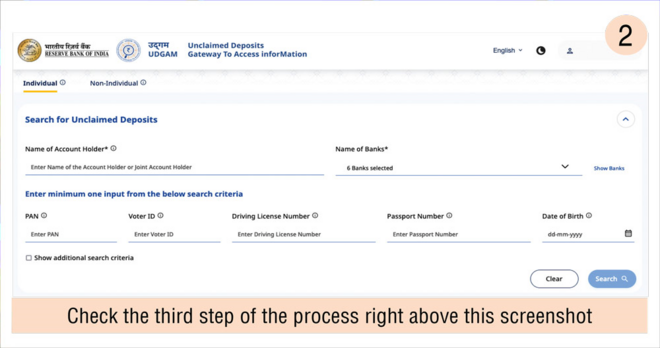

3. Enter at least one detail from the given options - PAN, voter ID, driving licence number, passport number or date of birth - and hit 'Search'. If none of these details is available, click 'Show additional criteria' and enter the address (see screenshot).

4. However, if the person appears in the search results, click 'Export PDF'.

5. The PDF will provide complete information, including the person's name, address, bank and an Unclaimed Deposit Reference Number (UDRN). It will also guide you on how to proceed with the claim process.

For instance, if you're dealing with an unclaimed account of the State Bank of India, follow these steps:

- Write a request letter to make the account operative and submit it at an SBI branch. See the format of the letter here.

- Submit your request letter and all the required documents, such as proof of identity, address and the latest photograph.

- The branch will verify your documents and make the account operative for transaction.

Point to remember

Review your investments at least once a year to avoid any hassles. That way, you can monitor your hard-earned wealth and treasure what's rightfully yours.

Also read: Found decades-old mutual fund certificates? This is for you