Index funds have garnered significant investor interest in recent years. This has prompted various fund houses to enhance their product offerings in this passive fund space. Initially, there were mainly funds tracking the Sensex or the Nifty. But now, we see many strategy indices and the funds tracking them being launched.

About the

DSP Nifty SmallCap250 Quality 50 Index Fund

This index fund by

DSP Mutual Fund

is the latest addition to this evolving space. It is available for subscription until December 19, 2023, and will track the Nifty SmallCap250 Quality 50 index.

The fund house seems to have strategically positioned the fund launch during heightened investor attention on small-cap funds. According to AMFI, the net inflows into small-cap funds this year have exceeded Rs 37,000 crore.

NFO snapshot

| Fund name | DSP Nifty Smallcap250 Quality 50 Index Fund |

| SEBI category | Index Funds / ETFs |

| NFO period | Dec 5-19, 2023 |

| Investment objective | Generate returns that are in line with the performance of the Nifty Smallcap250 Quality 50 Index, subject to tracking error. |

| Benchmark | Nifty Smallcap250 Quality 50 TRI |

| Fund manager | Anil Ghelani and Diipesh Shah |

| Taxation | Same as any other equity fund. If units are sold after one year: Gains beyond Rs 1 lakh are taxed at 10 per cent. (However gains up to 1 lakh in a financial year is tax exempt). If units are sold within one year: 15 per cent |

About the index

The Nifty SmallCap250 Quality 50 index holds 50 stocks from the universe of 250 stocks present in its parent index, Nifty SmallCap 250. For the uninitiated, Nifty Smallcap 250 comprises company stocks ranking between 251 and 500 from the top 500 based on market cap. Among these, the Quality 50 index selects 50 stocks based on three parameters - return on equity (ROE), financial leverage (debt/equity ratio) and earnings growth variability, over the last five years.

In the case of financial service sector companies, the debt-to-equity quality score is disregarded. An equal weightage is given to all three parameters for deriving the quality score. Being a market-cap-based index, its constituents may change, which are reviewed half-yearly in June and December.

Holdings and sector allocation

The index's top 10 holdings make up approximately 35 per cent of the fund's portfolio. In terms of sector allocation, Capital Goods takes the lead with an allocation of around 20 per cent, followed by the IT and Financial Services sectors.

Performance of the indices

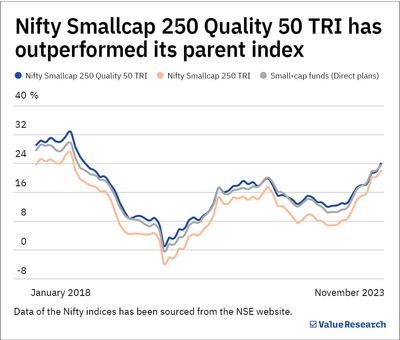

As can be seen in the graph, actively managed small-cap schemes have comfortably beaten the parent Nifty Smallcap 250 index over a five-year period.

Additionally, the Nifty SmallCap250 Quality 50 index seems to have slightly outperformed an average actively-managed small-cap scheme (back-tested data on NSE website). That said, the comparison is with an average small-cap scheme and choosing a good actively managed small-cap fund may help you earn even more.

Of the 16 small-cap schemes with a five-year history as on Nov 30, 10 have outperformed the Quality 50 index.

About the AMC

DSP Mutual Fund manages around Rs 1.36 lakh crore of investors' money distributed across 58 open-end schemes (as of Nov 2023). The AUM of equity funds stands at about Rs 78,447 crore (57 per cent), of which a mere Rs 2,347 crore is managed across equity ETFs and index funds.

When it comes to passive equity funds, it is a far cry from the kind of money being managed in the active space.

Our take

The Nifty Smallcap250 Quality 50 index has been launched recently and is, thus, pretty new. Therefore, it would be ideal to wait and watch how the actual performance comes out.

That said, whenever investing in small-caps, it is crucial to remember that they can experience extreme volatility in the short term. They can be very rewarding during bull runs but can also make your portfolio turn red and fall sharply during market falls. Taking a long-term perspective of eight to 10 years is advisable.