Indians exhibit a strong cultural affinity for gold, often acquiring it for investment and consumption. This cultural inclination laid the foundation for Kalyan Jewellers.

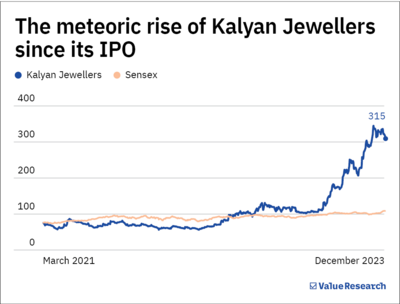

Kalyan Jewellers , a premier jewellery retailer in India, has demonstrated remarkable performance, yielding a 69 per cent annual return since its listing on March 26, 2021.

Notably, revenue and net profit have grown at an exhilarating pace of 29 per cent and 153 per cent, respectively, since FY21. The company is actively reducing its debt levels and aims to achieve a debt-free status in the coming years. It has reduced its total debt (excluding lease liabilities) from over Rs 3,590 crore in FY20 to Rs 1,563 crore as of the first half of FY24.

The net debt-to-equity ratio has decreased significantly from 0.8 in FY20 to 0.2 in the first half of FY24. Moreover, all new company-owned showrooms are delivering ROCE (return on capital employed) of more than 25 per cent.

Robust financials

ROCE surged from 7 per cent in FY21 to 19.2 per cent in Q2 FY24

| Q2 FY24 (TTM) | FY23 | FY22 | FY21 | Growth (%) | |

|---|---|---|---|---|---|

| Revenue (Rs cr) | 16056 | 14071 | 10818 | 8573 | 28.5 |

| EBIT (Rs cr) | 964 | 869 | 583 | 369 | 46.8 |

| EBIT margin (%) | 6.0 | 6.2 | 5.4 | 4.3 | |

| PAT (Rs cr) | 497 | 432 | 224 | -6 | 490.8 |

| ROCE (%) | 19.2 | 17.4 | 12.6 | 7.0 | |

|

TTM is trailing twelve months, as of Sep 2023 EBIT is earnings before interest and taxes PAT is profit after tax ROCE is return on capital employed |

|||||

Key drivers of Kalyan's recent growth

-

Pan-India expansion

Commencing with a single showroom in Kerala in 1993, Kalyan Jewellers has expanded rapidly to 175 stores (including 3 Candere stores) as of the second quarter of FY24. A formerly regional company, primarily active in the southern parts of the country, has transformed into a nationwide brand, with a predominant 56 per cent presence in non-south Indian states. Notably, these non-south Indian states exhibit higher SSSG (same-store sales growth) than their southern counterparts.

The adoption of the FOCO model (franchise-owned and company-operated) since FY22, especially in Tier 1, 2, and 3 cities in non-Southern India, has accelerated expansion, ensuring capital efficiency. Since June 2022, all 55 stores opened by the company have been under this FOCO model.

-

Localised jewellery designs

Recognising India's localised nature of jewellery consumption, Kalyan tailors its designs to match regional preferences. Complemented by more impactful marketing activities for specific occasions, this strategy contributes to the company's success. For instance, 'Muhurat' for wedding jewellery, and 'Aishwaryam' for the mass market.

'My Kalyan neighbourhood centres' further enhance customer engagement through door-to-door marketing, connecting with wedding ecosystem players for potential customer identification.

Future outlook

The organised jewellery sector is benefiting from favourable trends, with the share of organised players expected to reach 40 per cent by 2025 from 32 per cent in 2020.

Government initiatives like demonetisation, GST, and industry-specific policies such as compulsory hallmarking of gold jewellery and mandatory PAN for transactions above Rs 2 lakh have favoured organised jewellery retailers.

However, Kalyan faces intense competition from giants like Titan and local players. While the company has signed LOI (letter of intent) for future showrooms, any delays could impede store expansion. Additionally, trading at a high P/E of 69.5 times makes the stock expensive.

Also read: Hindustan Aeronautics: The high-flying PSU