Anand Kumar

Anand Kumar

Old-timers who have followed Value Research for years or decades must be somewhat surprised at the topic of this month's cover story. There's no denying it - for long years, 'momentum' has been a dirty word in everything we publish and, certainly, in everything I write. In fact, if one classifies equity investing as fundamentals-driven or momentum-driven, practically everything I write and say about investing is anti-momentum. So yes, your surprise is justified.

However, as the phrase goes, there's momentum, and then there's momentum. Our cover story is about momentum investing and not about momentum investing. Is that clear? Good. Let's delve a little deeper.

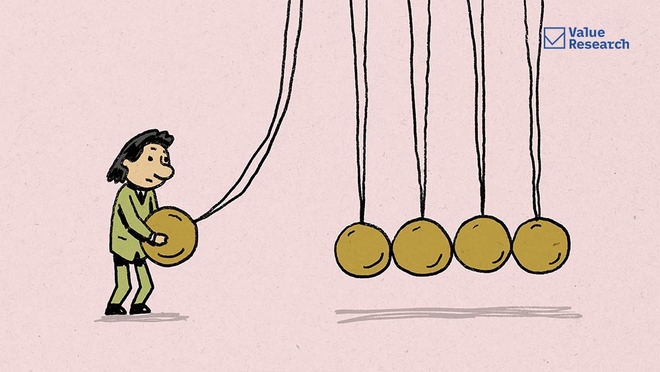

The dictionary definition of momentum is "The force or speed of an object in motion, or the increase in the rate of development of a process: A falling object gains momentum as it falls." Basically, in terms that apply to investing, momentum means that something that has picked up speed will continue to go faster and perhaps pick up speed. In all markets (not just stock markets), prices tend to follow the trend that is already established, at least for a certain period of time. If you know nothing about why the price of stocks or wheat or gold or potatoes should rise or fall in the near future, then you can guess that it will continue in the current direction, no matter what that is. If price is all you know and understand, then all your decisions must be made based on price alone. If you want to use big words, then this is also called technicals, but that's a separate joke topic.

Following prices is the most basic method of trading - and it does work, sort of. When the price of something rises, there's always an underlying reason. The reason could well be a good one, meaning other people have discovered why the price should legitimately be higher. On the other hand, it could be a bad one, meaning that prices are rising because somehow they have started rising, and a whole lot of people are buying because they hope that prices will keep on rising. Effectively, these are the two different types of momentum I discussed above.

The rise in the price of a stock is a signal. It could be a meaningless signal, or it could be a misleading signal, or it could be a useful signal.

A meaningless signal is when prices start rising or falling for no fundamental reason. This happens frequently in all markets - prices can gain momentum in either direction simply because a critical mass of buyers or sellers have jumped in for no reason other than the movement itself. A misleading signal is when prices initially move for what appears to be a valid reason but then detach from that reason and take on a movement of their own. It could also be just price manipulation. The useful signal is when prices rise in sync with improving fundamentals.

Valuations expand but are supported by growing earnings, sales, market share, etc. In these cases, the momentum builds on a sturdy foundation. Astute investors aim to identify and ride this kind of momentum, where the wisdom of the crowds and the underlying facts are aligned.

This distinction - between good and bad reasons for momentum - is what our cover story is all about. One thing I'd emphasise is that the very same price rise at the same point in time can be good for some investors and bad for others. If you've done your research homework and you understand why a price is rising, then it's good, but if you haven't, then the very same price rise is bad.

In the cover story, our team takes you through the entire thought process behind our distinctive view on momentum investing and then presents 10 case studies of specific stocks where a strong momentum has been visible. Momentum is a useful tool but not the ultimate guide, and that's what we hope to demonstrate.