Securities and Exchange Board of India's (SEBI) recent consultation paper on nominations has revealed some shocking facts. A startling 73 per cent of individually-held demat accounts either lack a nominee or have consciously opted out from choosing one. Though not as bad, 14 per cent of individually-held mutual fund investments also lack a designated nominee. In the case of jointly-held investments, this number stands at 34 per cent for mutual funds and 37 per cent for demat accounts.

Why you must have a nominee

Having a designated nominee enables passing the investments to loved ones in case of your absence. Because if you don't, its absence can throw the beneficiaries in a vortex of legal formalities before they can claim the money. Even worse, the money may remain unclaimed in some cases.

Considering its importance, the SEBI in July 2021 published a circular asking demat or trading account holders to either nominate a beneficiary or opt out of it by filling up a declaration form. A similar circular was released for mutual fund investors in June 2022.

While the initial deadline was set at March 31, 2022 for demat accounts and March 31, 2023 for mutual funds, it has been extended multiple times. Currently, it is June 30, 2024. Failing which, your investment folios and demat accounts will be frozen. This will prevent you from making withdrawals or fresh investments until the necessary details are provided.

The data above also underlines a significant disparity in nomination rates between joint and single holders of mutual fund folios, with 34 per cent of joint holders opting out or having no nomination compared to 14 per cent of individually-held mutual fund folios. While the surviving joint holder gains rights to the account or units in the event of one holder's death, it's prudent to nominate a beneficiary for an ease in transition of assets in cases where both holders pass away simultaneously.

73 per cent of demat accounts don't have a nominee!

So, we recommend you to choose a nominee before starting or continuing with your investment journey. To add or update your nominee(s) as an existing investor, follow the steps outlined below.

Steps to add or update a nominee (Mutual fund investments)

There are multiple ways to add or update a nominee. One way is that you can directly contact your fund house. But, instead of visiting multiple mutual fund sites, you can visit the MFCentral platform to add or make changes to your nominations in one go. To learn how to add or update a nominee in MFCentral, click here.

Steps to add or update a nominee (Demat account)

There are two methods to add or update nominees in your demat account. The first option is to access your demat account through your broker's platform. Once logged in, you can easily locate the option to manage your nominee details. Alternatively, you can directly visit either the CDSL or NSDL portal, depending on the depository participant associated with your broker. To update your nominee in CDSL, you'll require the Beneficial Owner Identification Number (BO ID), while for NSDL, you'll need the DP (depository participant) ID and client ID.

Apart from this, the procedure for both of them is broadly similar. Here's how:

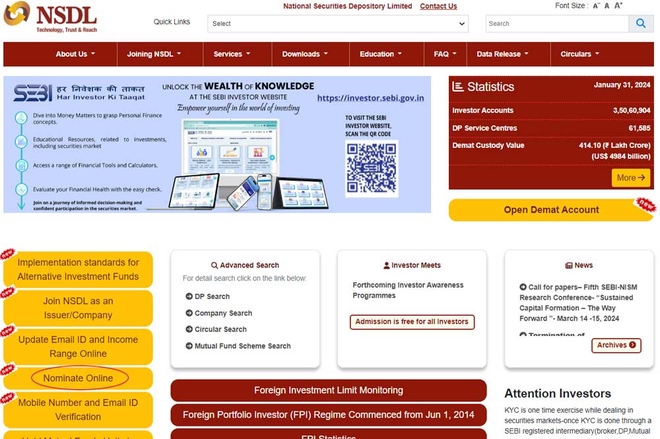

- Go to the NSDL or CDSL portal

- On the NSDL homepage, locate the 'Nominate Online' option. For CDSL, you can access the nomination feature by selecting it from the dropdown menu under 'Quick Links'.

- Enter the DP ID and Client ID in case of NSDL or BO ID in case of CDSL. You can find them in the profile section of your demat accounts. After that, enter your PAN (Permanent Account Number). You will receive an OTP (one-time password) on the mobile number registered with your demat account.

- After logging in, you'll find two options: 'I wish to Nominate' and 'I do not wish to nominate'

- Opt for 'I wish to nominate' and add or update your nominee(s).

- E-sign using Aadhaar. You will receive the OTP on your mobile number registered with Aadhaar.

That's pretty much it. Follow these steps and ensure your demat account isn't frozen. More importantly, it will be easier for your beneficiaries to get access to your investments in your absence.

Also read: Deadline for adding nomination extended