India has edged past China to become the largest market for Rado (a Swiss luxury watch brand). This led us to turn our gaze towards the luxury watch segment, especially Ethos, an Indian luxury watch retailer that's capturing the spotlight. As of Q3 FY24, it commanded a market share of over 20 per cent.

Also, it reported spectacular revenue growth of 22 per cent YoY (year-over-year) in Q3 FY24. This surge is impressive given the challenges it faced during the quarter-from the shraddh period, a time when buying luxury items is considered inauspicious, to the unexpected floods in Chennai affecting its stores and the disruptions due to renovations.

However, what truly piqued our curiosity was Ethos's future outlook. Hot on the heels of raising Rs 175 crore in November 2024 through a qualified institutional placement (QIP)—despite not fully utilising the Rs 375 crore raised from its IPO less than two years ago—Ethos has projected an ambitious 25 per cent annual growth over the next decade.

That's a bold forecast which led us to dig deeper. Does the company have a plan, or is it just another statement made in good times?

Beyond borders

The booming demand for luxury watches is not just limited to India. The global allure of high-priced Swiss watches mirrors the growing wealth of consumers worldwide.

The reason? The subsequent injection of liquidity by global central banks (after the COVID-19 pandemic brought economies to a halt) spurred a bull run in financial and real estate sectors, creating a new class of millionaires.

Strategic diversification

Ethos's aspirations stretch beyond luxury watch retailing. The company is branching into other product lines, including jewellery through Messika and luggage via Rimowa.

Additionally, Ethos has begun acquiring stakes in certain Swiss watch brands, like Favre Leuba, in order to achieve global distribution.

With nearly four decades of experience within the Swiss watch industry, Ethos's expertise is not just in retail but also in the supply chain. It supplies components to Swiss watchmakers through its parent company, KDDL. Such depth of experience offers a solid foundation for Ethos's global aspirations.

Opportunities in the Indian luxury watch market

The Indian luxury watch market is ripe with opportunity. India's slice of the global Swiss watch market may be small, but its burgeoning economy positions it as an emerging hotspot for luxury watches, much like China in the early 2000s. The recent India-EFTA trade agreement, aimed at reducing import duties on Swiss watches, could further stimulate demand by curtailing the grey market.

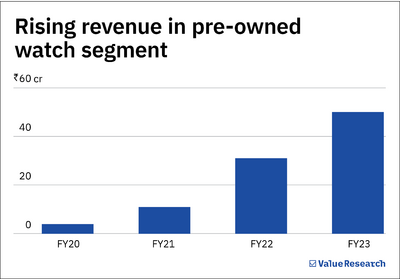

What is the company doing? It plans to capitalise on latent demand in Tier-2/3 cities, expanding its store network following successful forays into cities like Siliguri, Bhubaneswar, Raipur, and Surat. The company is also exploring the pre-owned (second-hand) watch market, which has seen accelerated growth, especially during the COVID-19 pandemic. (The supply disruptions caused the prices of some pre-owned models to surge three times the prices of brand-new watches.)

Additionally, Ethos has re-entered the lower-priced Swiss watch segment as a distributor, aiming to serve the high-end luxury market only.

Investor's corner

There is no doubt that Ethos has big ambitions and promising growth prospects. However, the competition landscape is ever-evolving, and market dynamics can be unforgiving.

While the company holds exclusive agreements with several Swiss brands, it lacks exclusivity with top-tier names like Rolex and Rado. Exclusive brands constitute 75 per cent of Ethos's portfolio but contribute only 30 per cent to sales.

One must also be cautious of the threats to this sector. In the case of luxury items, asset price destruction and increased pressure on high-net-worth individuals can prove to be a spoiler, as has been the case in China and Hong Kong in the past.

A slowdown is even more concerning for the company, as over 40 per cent of its assets are stuck in inventory, which can lead to cash crunch issues.

At last, the company's current valuation, a P/E ratio of 85, appears expensive.

Also read: The stock that turned Rs 10,000 into Rs 4.5 lakh in 20 years