The earlier mandate that required a complete redo of KYC (know your customer) norms, if it was not based on official documents, has been relaxed.

Earlier, investors had to physically submit documents with a KYC agency, but the recent change allows you to do so online. If the status is 'on hold', your ongoing SIPs, STPs, SWPs and redemptions will be restricted. In that case, you will have to submit an online request with your KRA or mutual fund portal and get it updated.

Meanwhile, if the status is 'validated' or 'registered', you need not worry further.

When can your KYC status be put 'on hold'?

- If your KYC is done with non-Aadhar documents and your email/mobile is not verified.

- If your KYC has been completed with documents other than those listed below and your email/mobile is not verified:

- Passport

- Driving licence

- Aadhar card

- Voter ID

- Job card issued by NREGA duly signed by a state government officer

- Letter issued by the National Population Register with name, address details

- Any other document as notified by the central government in consultation with the SEBI, markets regulator.

How to check your KYC status?

Investors can access any of these five KRAs - KARVY, CVL, NDML, CAMS, and DOTEX - to check their KYC status. Here's how you can do it using CVL:

- Visit cvlkra

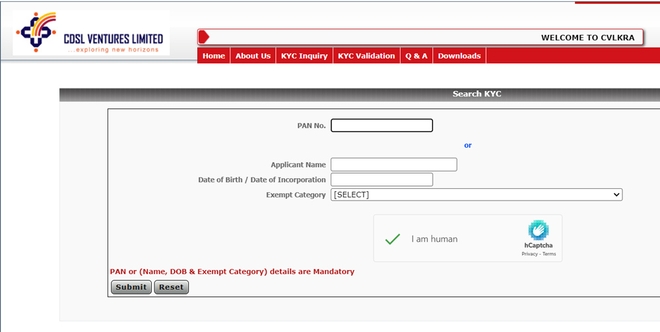

- Click on "KYC Inquiry" located at the top of the screen.

- Enter your PAN and click 'Submit'.

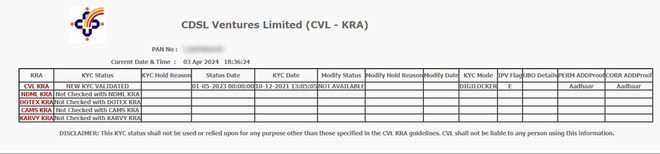

- You will then be able to see whether your KYC is on hold or not.

- When you visit the page informing your KYC status, as seen in the screenshot above, the second column is the most important one. It gives a one-stop update for all your funds.

Also watch: Common mutual fund terms explained