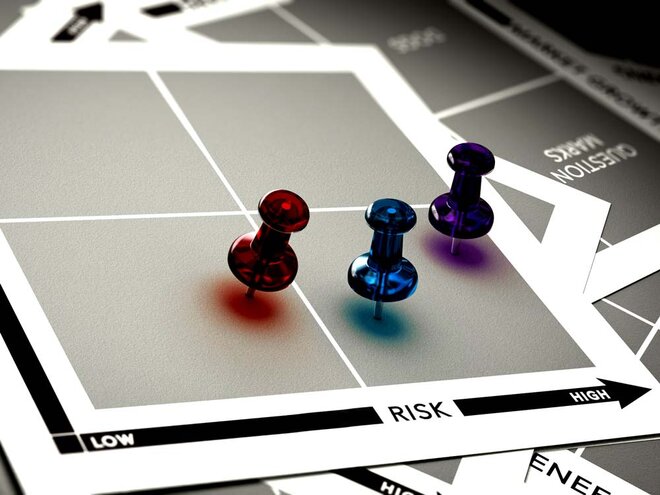

Wouldn't it be nice if at one glance you could know what your debt fund owns, how much risk it has taken on and where it stands vis-a-vis its peers? Value Research Fund Style (VRFS) for debt funds gives you a snapshot of all this without bothering you with complex data. Just like equity fund style, bond fund style is also a 3X3 matrix, which encapsulates a debt fund's interest rate sensitivity and portfolio credit quality. These are the two major risk factors that can affect a bond fund's performance.

Interest rate sensitivity is measured by the fund's average maturity, which is a weighted average maturity of all the securities held by the fund. When interest rates move down, bond prices move up, thus boosting debt funds' returns. The opposite happens when rates move up. However, changes in interest rates impact different maturities differently. The prices of long-term securities generally react more sharply than those of short-term securities to any change. Therefore funds with more long-maturity papers in their portfolios react more to interest fluctuations. Such funds have a high average maturity and lie in the top row of the VRFS matrix. Funds with low maturity are in the bottom row.

Apart from interest rate sensitivity, the VRFS for debt funds also rates the credit risk a fund is carrying. Credit risk is the risk of an issuer of a fixed income security defaulting on its obligations.

Each instrument that a fund invests in may have a different credit risk. As the government backs government securities and treasury bills, they are free from credit risk. But corporate bonds are not credit risk-free. Corporate bonds are given ratings like AAA, AA, A, BBB, BB, B (along with + or - prefixes) and others by credit rating agencies depending on the creditworthiness of the issuing company. AAA bonds are obviously rated the highest and those below BBB are rarely found in fund portfolios.

A fund with a higher allocation of high quality bonds lies on the left column of the VRFS matrix. A combination of credit quality and average maturity, when plotted on the VRFS, gives you a complete picture of the debt fund's portfolio. Since medium-duration debt funds invest largely in relatively longer tenure quality bonds, they usually lie on the top left corner of the VRFS matrix.

Liquid funds invest in very short-term debt instruments like call money market, treasury bills and commercial papers. These funds are a low-risk low-return product and they generally maintain a high quality portfolio. Therefore, they usually lie in the bottom left corner of the VRFS matrix.

Short-duration debt funds lie in between the medium-duration funds and liquid funds. These funds invest in corporate bonds of maturity ranging between 1 year - 3 years, commercial papers and treasury bills. Funds of this category usually lie in the middle row of the VRFS matrix.

Gilt funds invest in government securities and treasury bills, so they are free from credit risk. Thus gilt funds - both short-term and long-term funds - usually lie on the left column. However, gilt funds are susceptible to interest rate risk, which is more for longer maturities. Thus the position of gilt funds on the VRFS matrix will also depend on the maturity of the fund.

Of course, a fund's position on the matrix is not fixed. As fund managers adjust their portfolios to react to interest rate or credit risk changes in various securities, their position on the VRFS matrix changes. We recalculate the VRFS every month based on the latest available data. By regularly checking this section on a fund's page, you can easily keep track of both the fund's interest rate sensitivity as well as its credit risk.