You can pay income tax at the time of the disbursement of your monthly salary. Or else, you can visit the income tax portal that is taken care of by the Central Board of Direct Taxes (CBDT) and pay the tax. While using the income tax calculator, you would have to submit some basic details, including your annual income and expenses comprising home loan EMIs, interest on the education loan (if any), your tax-saving investments, your rent, tuition fees and so on.

During the 2020 budget, the government of India introduced a new tax regime without discarding the old tax regime. Now, you have the option to go for the new or old tax regime at the start of every financial year. No matter which regime you go for, you can calculate your income tax using any tax calculator in India.

Our income tax calculator is aligned with the updates proposed in the Union Budget 2023-24.

What are the sources of income?

When it comes to income tax, your income can be divided into the following heads:

Income from salary: The amount you earn is taxed under the income head. However, the employer-employee relationship should be there for paying tax under this head.

Income from capital gains: This is the profit earned when you sell any capital asset. This tax is levied only in the financial year when you make the actual sale.

Income from the house property: The rental income of a taxpayer falls under this head. The income is based on the annual value of a particular property, which is decided on the basis of the provisions of Section 23.

Gains/profits from any profession or business: If you derive income from any business or profession, including a lawyer, doctor, etc., then your income will fall under this head.

Income from other sources: This head is meant for all the income that cannot fall under the above-mentioned four heads. However, not all expenses are considered as a deduction under this head. Some of them include the income from dividends, prize money awarded for winning various games and so on.

How to calculate income tax?

When it comes to calculating income tax using an income tax calculator, you need to follow these steps:

Step 1: Find out the gross taxable income: To calculate this, you need to determine your net salary after removing all the deductions from your gross salary. Then, if you have any other income from various sources, you need to add that income to your net salary. Then, it will be possible for you to know your gross taxable income.

Step 2: Find out your total tax benefits: Now, you need to calculate the total benefits if you have any tax-saving investments or if you get any exemptions. Your total tax benefits may comprise all your investments under section 80c, your home loan interest (if any), health insurance premium and others.

Step 3: Find out your net taxable income: Now, you need to determine your net taxable income. For this, you need to subtract the total tax benefits from your gross taxable income. So, the formula is: Your net taxable income = Your gross taxable income - your total tax benefits

Step 4: Find out your total tax liability: Now, you can calculate your income tax liability for the financial year according to the applicable slab rate. You can opt for either the new tax regime or the old one. The new tax regime, which was announced during the Budget 2020, has a lower slab rate. But do remember that if you opt for the new tax regime, you cannot get several deductions, including Section 80C and HRA. The following tables will help you understand how much tax you need to pay in both old and new tax regimes.

Exemptions/deductions available under the old tax regime

The following are some exemptions and deductions available if you opt for the old tax regime:

| Nature |

Exemptions/deductions |

| 1. Section 16 |

Rs 50,000 standard deduction for salaried people |

| 2. Section 10(5) of the Income Tax Act, 1961 |

LTA |

| 3. Section 80C |

Up to Rs 150,000 |

| 4. Section 80D |

Medical expenses |

| 5. Section 80E |

The interest of high education loan |

| 6. Section 80G |

Donations for charitable purposes |

| 7. Section 80TTA |

Up to Rs 10,000 on the interest income from the savings account |

| 8. Section 24 |

Up to Rs 2 lakh on the interest given for the self-occupied home loan |

Exemptions/deductions available under the new tax regime

The following are some exemptions and deductions available if you opt for the new tax regime:

| Nature |

Exemptions/deductions |

| 1. Section 24 (b) |

The interest paid for a home loan for a property that is rented out |

| 2. 80CCD (1B) |

Employer's contribution to the NPS |

| 3. Section 80C |

Interest and maturity proceeds in Sukanya Samriddhi Yojna and the PPF |

| 4. Section 80CCH |

Deduction for the corpus fund |

| 5. Section 80CCH |

Your contribution to Agniveer C |

| 6. Section 57(iia) |

Deductions pertaining to income from family pensions |

| 7. Section 16 |

Rs 50,000 standard deduction for salaried people |

How to use Value Research’s income tax calculator?

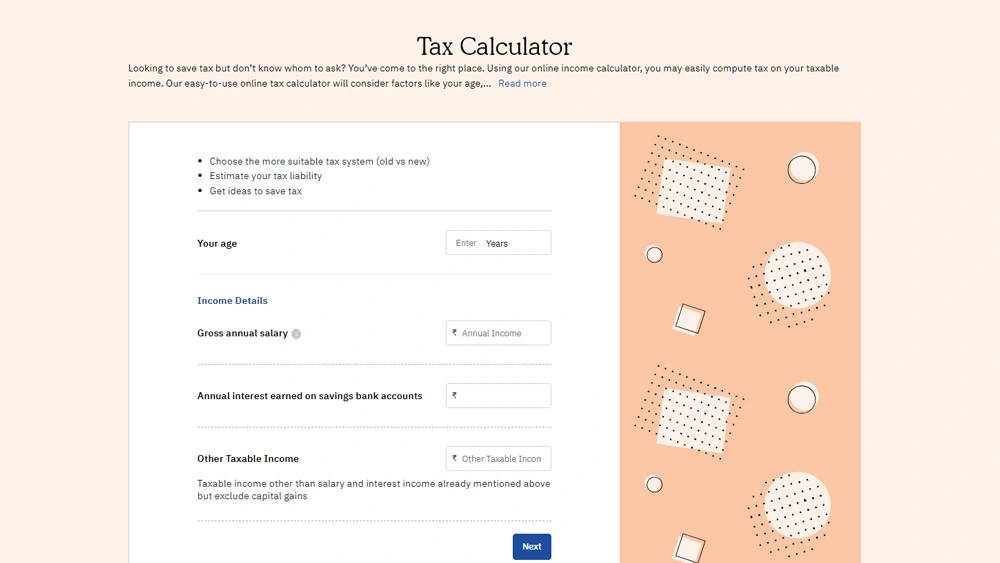

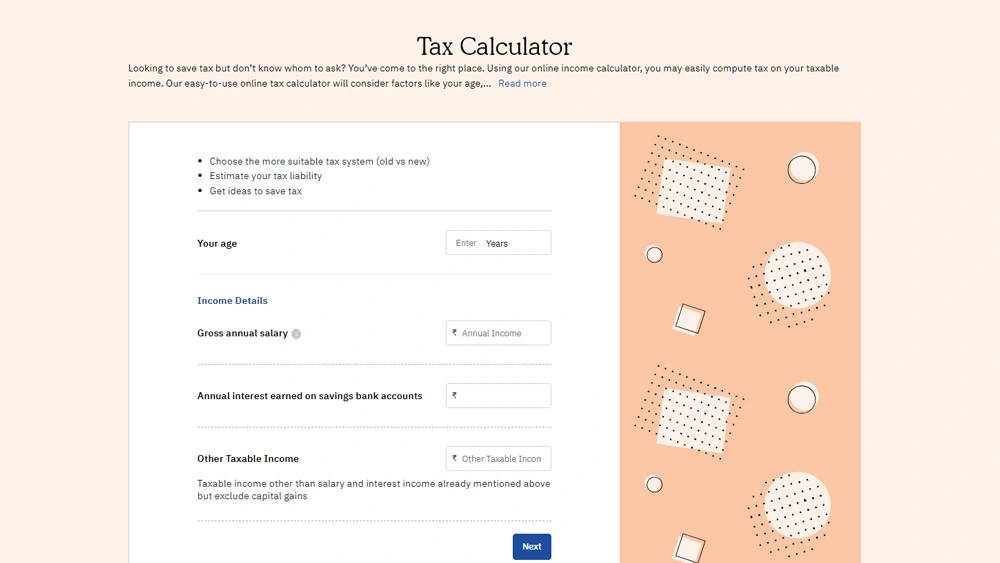

At Value Research, we provide an easy-to-use income tax calculator with which you can compute tax on your taxable income. Our income tax calculator considers all important factors, including your age, basic monthly salary, HRA, annual gross income, and tax-saving investments, to estimate your total tax under the old or new tax regime. Here is a step-by-step guide to using our tax calculator.

- Click on https://www.valueresearchonline.com/calculators/ and find the Tax Calculator tool under the ‘Essential Tool’ tab.

- Click on the Tax Calculator icon, and the page will open.

- Now submit the necessary information in the appropriate boxes and click on the ‘Next’ tab.

- Fill in the boxes and click on the ‘Next’ tab.

- On this page, you will have to declare some other details and click on the ‘Next’ tab.

- Now, you have to submit all your deductions falling under Section 80C. These include your SIPs in ELSS funds and others for the entire financial year. Once you submit, click on the ‘Next’ tab.

- On this page, you will need to submit other deductions, if any and then click on the ‘Calculate Tax’ tab. You will get the results within a few seconds.

Benefits of using Value Research’s income tax calculator

When it comes to your financial goals, you should plan properly to achieve them. Value Research's income tax calculator will be a great help to you. Here are some benefits of our income tax calculator.

Assist you in selecting the more suitable tax regime: Now, you can file taxes under the new or old tax regime. With our income tax calculator, you can understand all your tax obligations under both tax regimes. Besides, our tax calculator also provides you with ideas to save tax.

User-friendliness: Our income tax calculator is very easy to use. All you need to do is provide some basic details, which are easily available. A few clicks are all required. You can do it anytime and from anywhere, and that too for free!

Help you in your financial planning: Most of us do not know much about various tax-saving instruments, including the ELSS scheme, tax benefits on home loans, the NPS and so on. Our income tax calculator considers all these features and helps users know how they can save their taxes.

Common terms related to the income tax calculator

Exemption: Exemption refers to a certain amount which is excluded from your total income before the tax is calculated. Some examples of exemptions include the LTA of your salary components, the interest that you earn from tax-free bonds and so on.

Deduction: Based on Chapter VI-A, as well as Section 80, you get a deduction in your total taxable income. You can get a tax deduction for spending on the tuition fee of your child, your life insurance policies and so on.

Financial year: During this period, you need to collect and submit all your investment details. It starts on April 1 of a specific year and ends on March 31 of the next year.

Assessment year: All your income for a specific financial year is assessed in the following financial year. It is called the assessment year.

Previous year: In an assessment year, the previous financial year's income is assessed. Then, the previous financial year is known as the previous year.

See Less